Digital Financial Platform

Banks, credit unions, and financial institutions use digital banking platforms to give customers online channels for conducting traditional banking processes and activities. A majority of banking services can be digitized with the right solution partner.

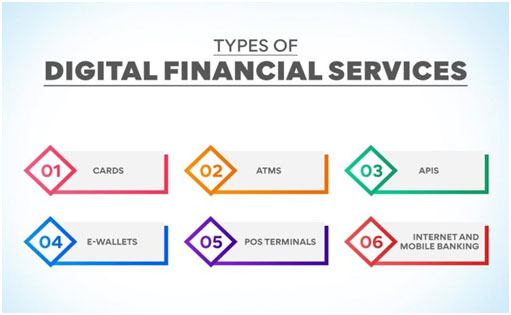

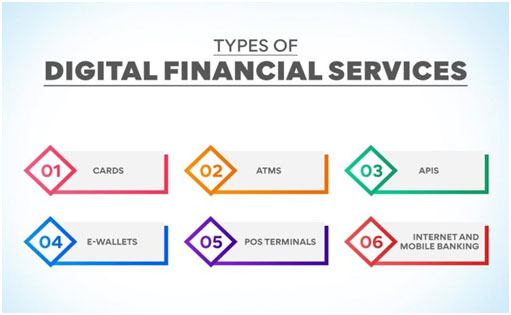

Digital finance is the delivery of traditional financial services digitally, through devices such as computers, tablets and smartphones. Digital finance has the potential to make financial services accessible to underserved populations in areas that lacked physical infrastructure for these services.

Benefits of digital financial management

Digital financial management can bring a lot of benefits to businesses. One of the key benefits is that it eliminates the need to print and store paper documents. We summed up the benefits of digital financial management for you. Read carefully and you can make your life easier in the future.

- Access to real-time information

All information recorded in the financial management systems can be viewed in real time, which means that it can be used efficiently to support management and decision-making. Indeed, fast access to data provides businesses with tools for developing new ways to use information.

- Better decision-making

When all the relevant financial information is easily accessible, decisions and solutions can be based on facts. Predicting future developments is easier, too. Thanks to easy access to information, your accountants can support you more efficiently.

- Freedom

A digital financial management system is with you everywhere you go. You can perform everyday tasks and check reports when and where it suits you. All you need is an internet connection and a computer or mobile device. Many tasks can easily be done on a smartphone. At the same time, outsourcing financial management tasks to your accountants is also easier.

- Ease and efficiency

With digital financial management, you can forget endless piles of paper. Many common tasks can be performed faster or even automated altogether. Receiving and sending invoices is a good example of such tasks. You no longer have to send invoices by post or spend time opening envelopes. Everything can be done with the click of a mouse. This means that you can focus on more important tasks, and it also helps to reduce costs.

- Flexibility

Digital systems enable flexible collaboration and interaction with your accountants. Different tasks can be easily modified and reassigned. You can communicate flexibly and conveniently face to face, by email or phone, or via video conferencing.

- Transparency of information

All financial management information is available to everyone who needs it. The availability and accessibility of the information can be restricted as necessary. This ensures security and prevents information overload.

- Integration of financial management into other business operations

Financial management will no longer be a separate unit within the company. When everyone has access to all the relevant information, it can be used efficiently in all aspects of business. Using their expertise, your accountants can bring a much-needed financial perspective to your business’ decision-making processes.

- Mobile working

Switching to digital financial management helps to make mobile working possible. When all the necessary information and tools can be accessed anywhere, there is no need to bring everyone together in the same place. This opens up new opportunities for managing work and allows for the organisation of work according to the needs of individual employees. This can significantly improve job satisfaction.

- Equality

Good access to information improves employee equality and encourages participation and commitment.

- Environmental friendliness

Digital systems reduce paper consumption and printing needs. When information is distributed through digital channels, there is less need for physical deliveries, which helps to reduce traffic-related emissions.